georgia property tax exemptions disabled

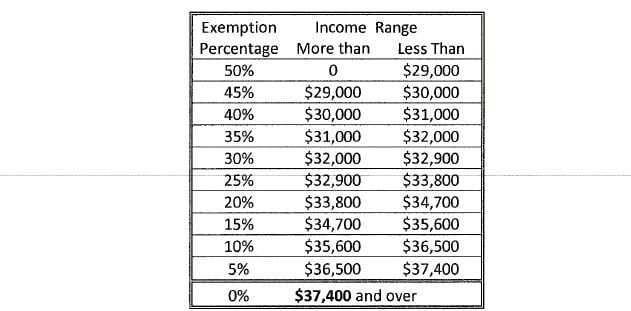

Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more. Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Property Tax Returns and Payment.

. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes. Disabled Veterans S5 - 100896 From Assessed Value. The exemption is granted on ONLY one vehicle the veteran owns and upon which the free Disabled Veteran DV license plate is attached.

If you would like to apply for a NEW exemption applications must be filed at the Evans office on 630 Ronald Reagan Drive Evans GA 30809 Building C in the Property Tax Office. Georgia exempts a property owner from paying property tax on. DeKalb County offers our disabled residents special property tax exemptions.

Basic Homestead Code L1 You must own your home and reside in the. This exemption can be applied to up to. Applicants for senior or disability exemptions must apply in person and present copies of the previous years federal.

The qualifying applicant receives a substantial reduction in property taxes. Disabled Veteran Exemption and Conservation Use Exemption are some common exemptions a property owner may qualify for. This exemption may not exceed 10000 of the homesteads assessed value.

As of 2020 disabled veterans in Georgia are exempt from paying state property taxes on the first 150000 of the value of their home. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. Not all Veterans or homeowners qualify for these exemptions.

48-5-52 Any qualifying disabled veteran may be granted an exemption of 100896 from paying property taxes for state county municipal and school purposes. 140 HENRY PARKWAY MCDONOUGH GA 30253 164 BURKE STREET STOCKBRIDGE GA 30281 770-288-8180 opt. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of.

Veterans who qualify for the Purple Heart or. What is the property tax exemption for over 65 in Georgia. Currently there are two basic.

Property Tax Homestead Exemptions. The value of the property in excess of this exemption remains taxable. To apply for a.

If youre a disabled veteran youll qualify for up to a 60000 exemption and perhaps. Disabled veterans and their surviving spouses can apply for a 50 property tax exemption on the first 200000 of their primary residences actual property value. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally.

Exemptions can vary by county and. If youre 62 years old or older. The only disabled property tax exemption in the state of Georgia is reserved for veterans.

County Property Tax Facts. Types of Property Tax Exemptions in Georgia To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Property Taxes in Georgia.

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Cherokee County Tax Assessor S Office

States With Property Tax Exemptions For Veterans R Veterans

Property Taxes Are Going Up What Homeowners Can Do About It

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

5 Property Tax Deductions In Georgia For You Excalibur

Veteran Tax Exemptions By State

Property Tax Exemption For Disabled 11 Things 2022 You Need To Know

Motor Vehicle Division Georgia Department Of Revenue

The Ultimate Guide To Property Tax Laws In Georgia

Georgia Homestead Exemption Reminder Brian M Douglas

Apply For Property Tax Exemptions Now To Save Next Year The Clayton Crescent

Exemptions To Property Taxes Pickens County Georgia Government

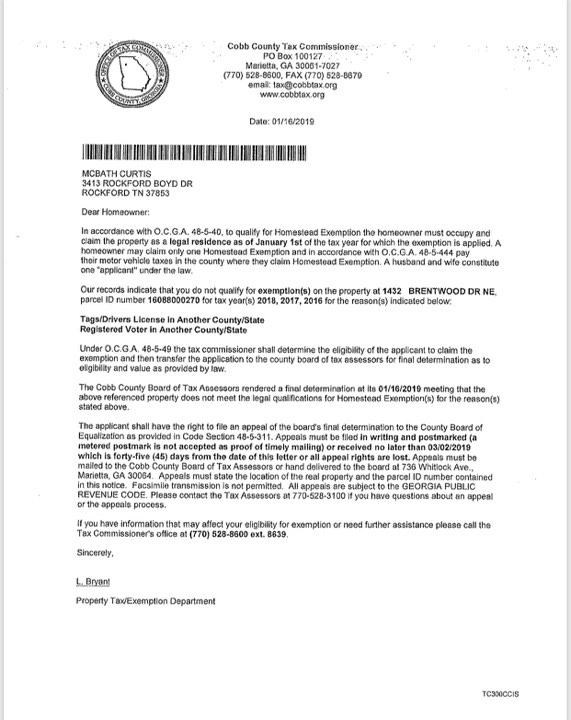

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Brookhaven Seeks Property Tax Savings For Homeowners Reporter Newspapers Atlanta Intown

Charlton County Tax General Information

Property Tax Calculator Estimator For Real Estate And Homes

Property Tax Exemption For Disabled 11 Things 2022 You Need To Know